Mirror Image

As we look into what to expect in 2023 for the global equity markets, the term “Mirror Image” comes to mind.

As we headed into 2022, investors expected inflation would be transitory with the prospect for only one or two increases in the Fed rate. What we got was significantly different – inflation jumped to levels not seen in 40 years, leading the U.S. Fed to raise rates from zero to 4.25%-4.50%. Adding the war in Ukraine, an energy crisis, and China lockdowns; you have a toxic mix that sent global markets down more than 20%.

Fast forward 12 months, as we enter 2023 investors are faced with a mirror image of 2022, which bodes well for solid upside returns across global markets. Inflation has peaked and will fall rapidly in the first half of the year. The Fed is slowing down the pace of rate hikes, which is forecast to peak in June at 5%. The Fed is slowing down the pace of rate hikes, which is forecast to peak in June at 5%. Developed markets should only endure a shallow recession while China has removed lockdown restrictions; paving the way for an acceleration in Chinese economic growth. Coupling these positive economic data points with equity valuations that currently range from cheap-to-reasonable, as well as low investor sentiment with a decent amount of bad news already being priced-in; you have a setup that is conducive for attractive positive returns in global equity markets.

Recession – short & shallow

The term recession can scare the daylights out of investors and is currently becoming more ubiquitous. The strong labour market and upward pressure on wages is what has primarily driven the Fed to raise rates at the pace that they have. The only way to break the upward wage cycle is to weaken the labour market by slowing down the economy – standard economics 101. Most economists are forecasting that major developed economies will go into recession in the first half of 2023. You can expect the major news agencies to beat the recession drum. However, the recession is expected to be mild and inflict a de minimis amount of pain across main street.

Why do we foresee a short & shallow recession?

Typically, ugly recessions occur due to too much leverage in the system; so, as the economy slows down and unemployment increases, consumers and businesses are no longer able to repay their debt which leads to defaults and a vicious downward spiral as lending essentially comes to a halt. This time it is different as the U.S. consumer remains comfortably positioned with over $1trl in excess savings, and net worth near record levels given the run-up in house prices and equity markets over the last 3 years. Household debt levels and debt serviceability remains at historically low levels.

Likewise, U.S. businesses remain equally well positioned to sustain a temporary downturn. For this reason, we don’t see a major default cycle dragging the U.S. economy into a depression.

Rate hikes coming to an end, as inflation turns to disinflation

After the unprecedented rate hikes we experienced in 2022, the rates markets are currently pricing in just two more 25bps hikes in 2023 (February and March meetings). Thereafter, expectations are for the Fed to pause at the 5% level before potentially cutting rates down to 4.50% by year end.

The slowdown in rate hikes is being made possible as 2022 inflation turns to disinflation moving into 2023. In our minds the pace of disinflation is the most important factor in determining the Fed’s rate path going forward.

The path for inflation gets significantly more favourable as we head into February and begin to anniversary Y/Y supply-chain and war related price spikes in goods and commodities. Our view is for U.S. inflation to drop below 5% by March and head towards the “targeted” 2% by mid-year.

Peeling back the inflation onion

Given the importance of inflation in the rate hike cycle and its knock-on effect on global risk assets, it is important to get a handle on the moving parts that are driving inflation. In a recent note we compared inflation to a 3 layered onion; the first layer being commodity driven inflation, the second being goods inflation, and the third layer related to services. The first two layers have been addressed and are showing definite disinflationary trends. It’s the third layer that is more structural and therefore important to understand.

Service inflation primarily relates to housing related prices and wage inflation. Housing / Shelter inflation makes up over 33% of the CPI calculation. While we have seen solid growth in house and rental pricing over the last several years, higher interest rates are beginning to put pressure on house prices and rental rates. While the nature of the housing component calculation means current pricing takes time to work its way into inflation numbers, current pricing trends suggests shelter inflation is cooling.

The other major component of service inflation is wage inflation. We are watching the labour market closely as wage inflation remains stubbornly high. As economic growth slows, and employees become more cautious in quitting jobs we anticipate wage inflation to cool as a result.

Equity markets setting up nicely

We entered 2022 with the S&P 500 forward PE at 21.5x; 3 points higher than the 5-year average multiple and, in a general sense, trading at a premium. The 20% depreciation in the S&P 500 was solely attributable to PE multiple contraction as increasing interest rates weighed on valuations across the market. This year we start at a much more attractive valuation level; at 16.5x forward earnings the S&P 500 is 11% below its average multiple, providing a better risk/reward equation for the year ahead.

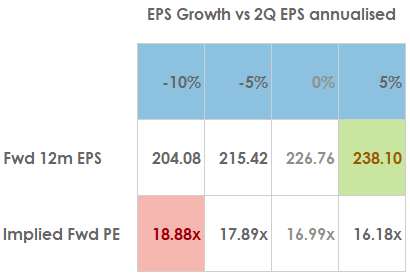

Currently, market analysts are forecasting earnings to grow 5% Y/Y in 2023 for the S&P 500. While we are still 12 months away from the end of the year and a lot can still happen, we believe the market is pricing in a more draconian outlook for 2023 earnings. During a typical “non-severe” recession, S&P 500 EPS declines on average 10%. Assuming a mild recession and applying this logic to 2Q peak earnings, gets us to a forward multiple for the S&P 500 of approximately 18.5x. This is basically in line with average levels, suggesting a mild recession is already priced in.

Consequently, we are starting 2023 from a valuation perspective where a degree of pessimism is already priced. Thus, providing a good starting position for price appreciation as we move through the year.

Lots of technical support for positive performance

The are several technical factors that support our optimistic view on global equity markets in 2023.

1) Equity markets typically rebound after a big drawdown year. Historically, after a 25% or more pullback the S&P 500 returns an average 20% over the next 12 months.

2) Equity markets rally once the Fed begins to pivot on rate hikes. 12 months after the Fed is done hiking rates the S&P 500 increases an average of 13%.

3) Global Fund Managers are sitting on the most amount of cash since July 2000. This suggests that there is a flood of money waiting to reenter global equity markets.

4) Global Fund Managers remain significantly underweight equities. In line with the previous point, once equity markets begin to move, there is lots of room for fund managers to increase their positioning in global equities.

Since nothing happens in a straight line, particularly when it comes to equity markets, we expect some volatility through the first half of the year. But we believe we are approaching the light at the end of tunnel as equity markets are set up for a strong 2023. The catalysts will be cooling inflation and a more dovish Fed, combined with reasonable valuations, underweight equity positions, and a wall of cash waiting on the sidelines – together these have the potential to deliver good returns for investors this year.