This month we’re just touching on two main points in a shorter read for May than you may be accustomed to. On the global front, we have a look at the raging inflation debate and where we see things currently, while on the local side we cast our eye across recent bank earnings/trading updates and reflect on these in the context of a global pandemic. We’ve thought the banks have been mispriced for some time and believe that this current round of results from the big 4 supports this thesis.

Enjoy

International Section

By the numbers | The inflation debate

Local Section

By the numbers | SA banks, risk to the upside | Stock Comments

International section

By the Numbers

The inflation debate

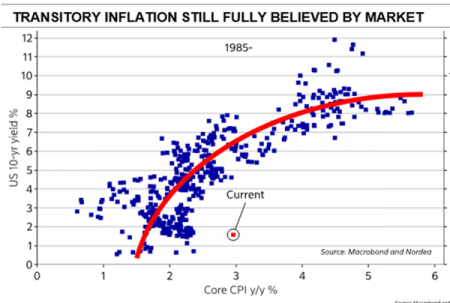

Currently the US Fed has stated that they will not be thinking about moving rates until inflation is averaging above 2% and employment levels have returned to pre-pandemic levels. The Fed estimates this point will only be reached in the latter part of 2023 to early 2024. On the other hand, market sentiment is suggesting the Fed will move rates as early as 2022.

While current Inflation readings are spiking above 3% as of the latest readings, the Fed suggest that these levels are transitory and are a function of easy year ago comparisons during the height of lockdowns and price surges due to supply bottlenecks.

Additionally, looking at market pricing we barely see run-away inflation being priced into any inflation sensitive financial instruments.

- US 10-year treasury bond are only yielding 1.62%; still at the bottom end of the last 5-year range.

- While 5- and 10-year breakeven inflation rates are suggesting higher levels of inflation of approximately 2.5%. Yes, it is higher than previous years but hardly run-away inflation and certainly still within the Fed goals of “long term average inflation at 2%” target.

Argument 1: demand > supply = inflation

From an inflation hawk’s perspective, they see Demand outstripping Supply and therefore driving inflation higher, causing a wage growth spiral that creates more “sticky inflation”.

- Demand Driven Price Hikes – a combination of stimulus cheques and lockdown restrictions have driven excess savings levels among US households to more than $2trln, or 6% of GDP. As the economy unlocks, it is unleashing massive pent-up demand spending. This on top of supply shortages and logistical bottlenecks will drive prices higher and feed inflation.

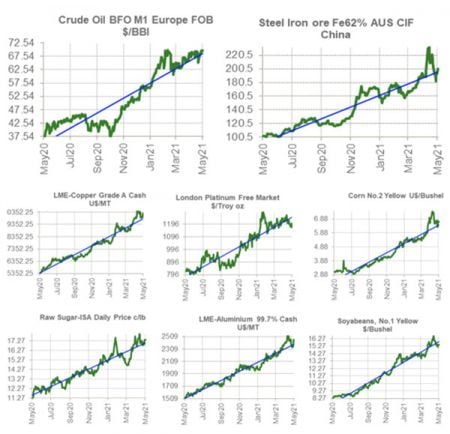

- Commodity Prices for almost everything has gone through the roof.

- While Sales to Inventory ratios remain at historic lows as supplies run out.

- Service vs Goods Inflation – Another argument for a more sustained inflation push is the fact that Service inflation has typically averaged 2.8% while Goods inflation has been dragging down total inflation to an average of 0% for the last 20 years, as China and globalization drive down pricing of goods. We can see the reversal of trends as Goods disinflation declines due to the slowing of globalization as well as an increase in transport costs. All of this will drive overall inflation above historic levels.

- Wage growth – Wage growth is one of the main components of structural inflation. Some economists note that employers are battling to appropriate workers and will have to increase wages in order to entice labour back into the work force.

Argument 2: inflation is transitory and won’t be sustained

On the dovish side of the argument, there are several powerful theories that are also put forward.

- Prices have already peaked and are now rolling over – The price spike of raw materials and transport costs was primarily driven by a burst of pent-up demand with manufacturing remaining curtailed alongside transportation bottlenecks. We are already seeing prices of raw materials and transport costs rolling off their earlier peaks.

- Commodity prices have zero correlation to inflation – History tells us the rise in commodity prices has very little impact on structural inflation.

- Wage inflation = NON-ISSUE – Wage inflation is the biggest driver of inflation and remains a non-issue. There are 9mln people unemployed within the US that had jobs pre-covid. The availability of workers will increase considerably over the next few months as pandemic unemployment assistance ends and encourages people to return to work. Inflation will only become a problem when wage growth significantly outpaces productivity growth and historically, firms tend to pass on these higher costs to consumers.

- Global Debt at records levels – Debt is essentially deflationary once it gets above a certain level. We currently have global debt to GDP at levels never seen before. As the marginal return on debt declines it begins to weigh on demand.

- Inflation outside the US is not an issue.

- Technologically enabled innovation continues to drive disinflation– Technology has been a huge driver of productivity and driving the cost/unit down. We have seen an acceleration of IT spending over the pandemic which will continue to drive productivity going forward.

Conclusion

It seems likely to us that the inflation debate will continue to grind on through to October when the easy comparison from last year begin to dissipate, pandemic benefits end, and supply chains have had time to catch up. Then only will we get a clearer indication of whether current inflation pressure is transitory or not. In the interim, we continue to see the market see-sawing between the Hawks and Doves and expect the US Fed to hold their position on keeping policy accommodative well into 2023. Meanwhile, strong monetary and fiscal policy support long-side economic growth and should be conducive to equity upside.

International Section

By the numbers | The inflation debate

Local Section

By the numbers | SA banks, risk to the upside | Stock Comments

Local section

By the Numbers

SA Banks, risk to the upside

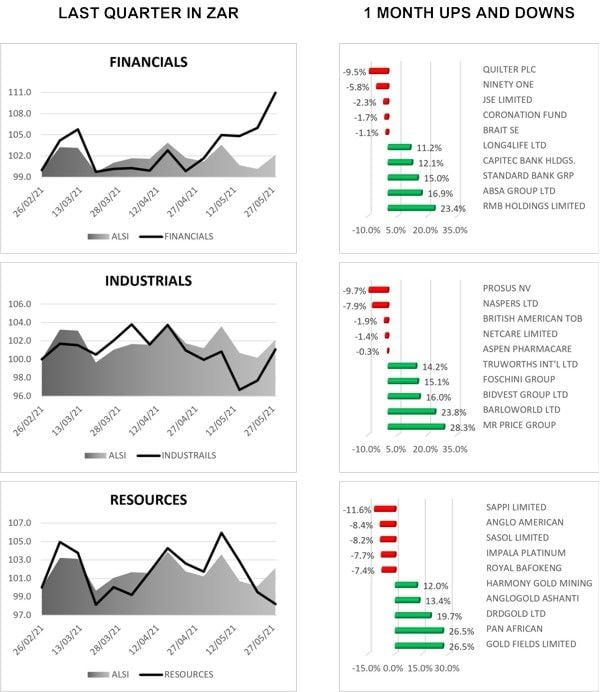

Fast forward to 2021 and we find ourselves in a very different environment. Globally the vaccine rollout has economies returning to normal and locally we have seen the SA consumer show resilience many thought did not exist. Year to date, the financial sector has largely underperformed relative to the rest of the market as investors remained cautious over the strength of SA individuals and businesses. However, over the past month we have started to see an increased interest in the sector (as evidenced by the red line), as investors and analysts alike began to question whether the caution remains necessary.

In May we began to see a change in investor appetite for the sector with the Fini 15 index gaining over 10%. This was driven by a combination of increased appetite for risk assets in addition to operational updates from the SA banks indicating a stronger environment than that being priced in by the market.

Absa, Nedbank and Standard Bank have all released voluntary trading updates for either their first 3 or 4 months of trading in 2021. While there are some differences, the general commentary amongst all three follow the same lines.

- Net interest incomes grew by low single digits or remained flat when looking on a constant currency basis.

- Gross loans and advances remained under pressure with customer loans in Home Loans and Vehicle Asset Financing showing strength while corporate loans and advances remain low to negative as corporates remain cautious choosing to pay down existing facilities.

- Credit impairments are substantially lower with improvements being seen in credit loss ratios.

- ROE’s are staging a recovery but remain below Cost of Equity for both Standard and Nedbank.

- All three have guided to a substantial improvement in interim headline earnings with the resumption of dividend payments anticipated from at least Standard Bank.

While the risk of a third wave lingers, SA banks have shown their resilience through the challenges of 2020. The strength of the average South African consumer has proven greater than expected and while corporates remain cautious the overall banking environment in SA is proving to be stronger than anticipated.

From a price to book value perspective, SA banks still screen well with current levels remaining comfortably below longer-term averages.

Stock Comments

Redefine Properties Interim Results

In its 2021 first half results Redefine Properties showed an improving performance following on from the challenges faced in 2020. Revenues were impacted by the deconsolidation of their European Logistics Investment and the sale of Leicester Street and other non-core local properties over the period. In addition, performance was impacted by differing lockdown levels over the period which necessitated negative rental reversions and the granting of further retail relief in order to support tenants. The impact on topline was the main contributor to the decrease in distributable earnings which reduced by 21.8% to 26.18 cents (1H20: 33.46 cents). Net Asset Value per share improved 0.7% to 719.74 cents when compared to its FY20 result of 714.85 cents and declined 18.6% when compared to its pre-covid interims ended 28 Feb 2020 of 884.26 cents.

Redefine’s position in Poland’s Echo Polska (EPP) was impacted by the continued hard lockdown measures adopted by the Polish government. As a result, EPP withheld dividends during the period to preserve financial flexibility and bolster their own liquidity, which impacted Redefine as a result. Given the positive strides being made in Poland’s vaccination strategy, Redefine is anticipating a strong rebound in the Polish economy supportive of a buoyant retail environment in 2022.

Balance sheet strength was a major focus over the period. Loan to value improved to 44.3% in the first half down from 47.9% in its FY20 with reduction initiatives involving retention of earnings and disposal activity along with forex benefits being the main drivers behind this. Management is targeting a LTV of 41% for FY21 with the two major drivers to achieve this being further disposal activity of non-core assets and retention of cash from operations.

CEO Andrew Koning believes the bottom of the cycle has been reached and feels Redefine is well positioned to benefit from vaccine rollouts both locally and offshore as it “leads to more mobility in the system”. In addition, his view on the return to office space is that normality will return despite concerns of far less demand in the “new normal”.

The board decided to defer their interim dividend to year end to add additional flexibility and to bolster liquidity in the uncertain environment (risk of increased lockdowns given a severe third wave). This was largely anticipated by the market. Redefine continues to trade at a significant discount to its underlying NAV (currently around 40%) despite its stronger performance over the past few months. In addition, consensus forecast anticipates a full year distribution of 10%. NVest remains a holder and buyer of Redefine on appropriate mandates.

Ultimately, current valuations are attractive, and we continue to bang the drum on SA banks. If loan growth remains subdued (and not yet back at normalised levels), combined with the requirement for high capital adequacy ratios, should advances not pick up as expected, surplus cash will liklely be paid out to shareholders, resulting in increased total shareholder returns over the years.

AB InBev Q1 2021 Results

The global brewer released a stellar set of Q1 results with topline delivering results ahead of pre-pandemic levels and outperforming market expectations by far. Organic volumes were up 13.3% well ahead of consensus expectations of 7.3% with organic revenue +17.2% also beating market consensus of an +8.7% increase. Organic EBITDA was up +14.2% also beating market expectations with consensus anticipating an increase of +6.6%. Results on the EPS line were closer to market expectations with underlying EPS increasing to $0.55 from $0.51 in 1Q20.

All regions beat market expectations with performance as follows:

- North America, the group’s largest region posted organic revenue +5% (consensus +1.5%).

- Middle Americas delivered +16% in revenues (consensus +7%).

- Colombia produced 20% growth in both organic top and bottom line and represents a large market for AB InBev.

- Mexico indicated more than 50% of revenues were ordered through their digital platform B2B.

- South America produced EBITDA growth of 23.3% a large beat given consensus estimates of +2.7% on concerns earnings would be impacted by carnival not being held this year.

- Europe, the Middle East and Africa felt some strain given trade restrictions in some areas and bans in others like South Africa. Organic revenue declined -0.4% versus consensus -7.5%.

- Asia pacific grew organic revenue by +61.7% (consensus +51.2%) largely due to low comparatives in the prior year.

Their strategy of premiumization is starting to pay off with premium now representing more than 30% of revenue having grown its revenue by 28% in 1Q21. Given the higher dollar profit per hl on premium brands, the growth in revenue was also accretive to bottom line. Global brands is a large contributor to this, growing revenue by 29.5% and by 46.4% outside of home markets versus 1Q20.

AB Inbev trades on a consensus foreword PE of 21.2x with a 1.6% dividend yield. The stock remains one of our core holdings for appropriate mandates.

International Section

By the numbers | Inflation | Earnings in the driving seat

Local Section

By the numbers | SA consumer resilience continues | Bank valuations | AB Inbev results