At home, it seems we can’t stop scoring own goals, adding to the list of load shedding, inflation, and interest rate hikes. We heard speculation that the SA government may or may not have supplied weapons to Russia. While a who’s who in government came out and denied it, reiterating our non-alignment approach, investors did not stick around to find out the truth. The rand blew out to R19.80/$ after starting the month at R18.30. 10-year government yields increased from 10.12% to 11.40%, and the JSE All Share Index dropped 4%. The fallout across the markets worked its way into Main Street,

as the significantly weaker rand presaged higher inflation expectations, leading the MPC to increase interest rates by a further 25bps, taking the prime rate up to 11.75% — a level not seen since 2008. Despite excessive savings and moderately levered balance sheets, the pressure of the SA customer has been unrelenting. All this pressure has been weighing on the local stock market, particularly domestic cyclicals, such as retailers and banks. Valuations have seldom been cheaper, and opportunities across the listed SA companies have rarely been this attractive.

As the adage goes, the best time to buy stocks is when there is blood in the streets. Lift up your feet, people, it’s bleeding out there…

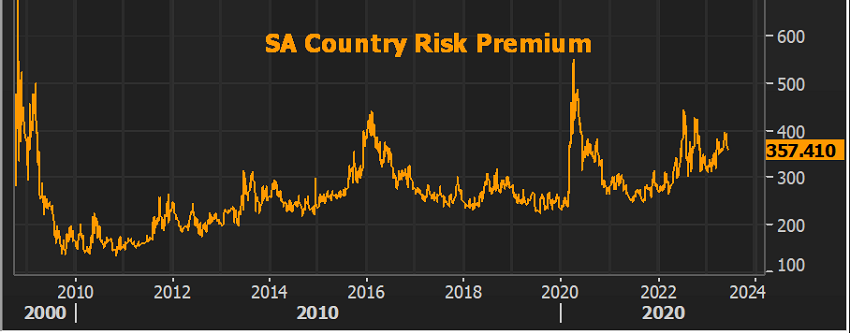

Sentiment towards SA is at levels only seen during Covid and GFC lows, as is evident by the South African CDS spread — the risk premium investors require to insure against SA debt losses.

Looking over the horizon, we see things improving. Khonie highlights that load shedding is set to decrease significantly as we head towards the end of the year. Interest rates and inflation have peaked, and we expect the first cuts in local interest rates in early 2024. So, while things feel dire now, we are, in our minds, at or close to the low point, with stocks priced as if the current situation will continue ad infinitum, making this a buyer’s market.

SA retailers and SA banks are trading at valuations that are too good to ignore. SA banks are currently trading at 2 standard deviations below their average price-to-book multiples.

While SA Retailers are more than 1 standard derivation below average Price-to-Earnings multiples.

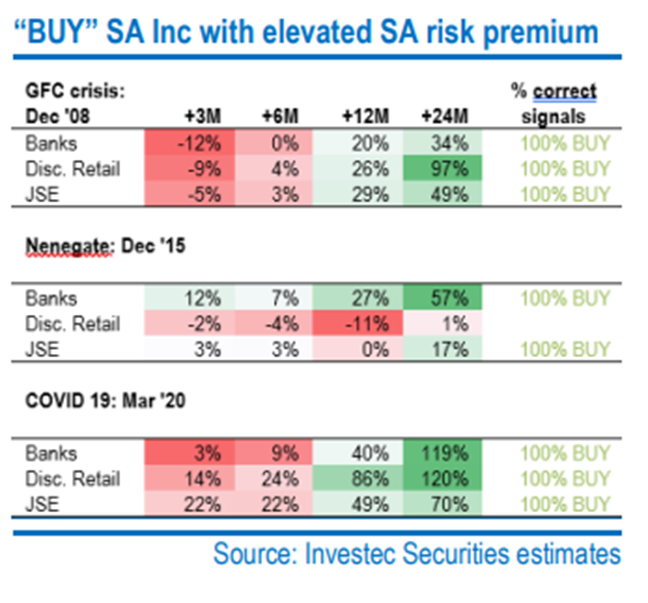

Research conducted by Investec shows that when risk premiums reach current levels, the potential upside return is extremely attractive, ranging from 40% to 120% over a 24-month period.

Moving across the Atlantic, as the mini-crisis among US regional banks move into the rearview mirror, all focus has been on the debt ceiling and whether the Democrats and Republicans could come together to avoid bringing government services to a standstill. At the eleventh hour, the two parties agreed to lift the debt ceiling; averting any major fallout. The stock market generally brushed off this political to-ing and fro-ing.

More importantly, from a market’s perspective, the general message coming from the Fed is that they intend to pause rate hikes at the June meeting to assess the data further. Currently, forward rates are anticipating one more 25bps hike in July and then a similar cut in November, exiting the year at 5.25%, pretty much in line with the most recent Fed dot plot expectations.

Year-to-date, S&P 500 is up approximately 11%”, but all of this performance has been driven by just 7 stocks: Apple, Meta, Alphabet, Tesla, NVidia, Amazon, and Microsoft. These 7 names are up an incredible 53% YTD, driven by the AI phenomenon sweeping across the market (Liza looks into the potential growth and opportunities in the AI space). The remaining 493 members of the S&P 500 have gone nowhere this year.

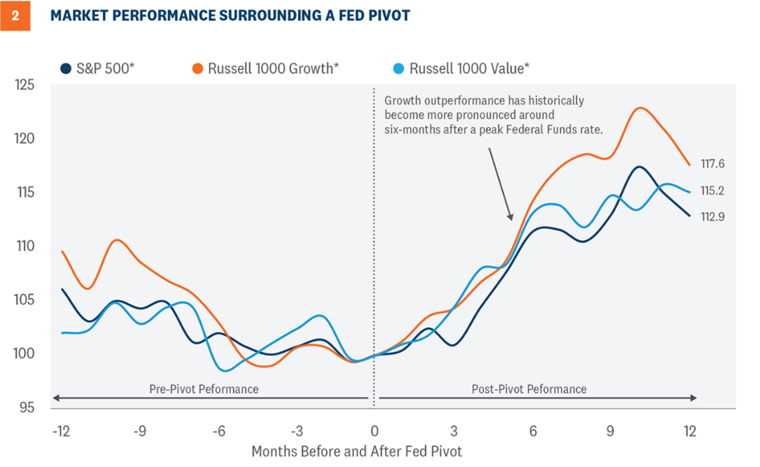

While the Fed remains data-dependent, investors are sitting on the sidelines, waiting for confirmation that the rate-hiking cycle is over. History suggests that once the cycle ends, stocks enjoy solid 12-month returns.

Opportunities outside of Tech are starting to emerge as valuations and earnings expectations begin to adjust to levels that, in our view, incorporate a healthy margin of safety.

We are approaching the phase of the cycle that favors risk assets. It is always challenging to time these things perfectly, so the best strategy is to be slightly early rather than late to the party.

International section

By the Numbers

May was a busy month with lots going on across global markets. It’s hard to know where to start.

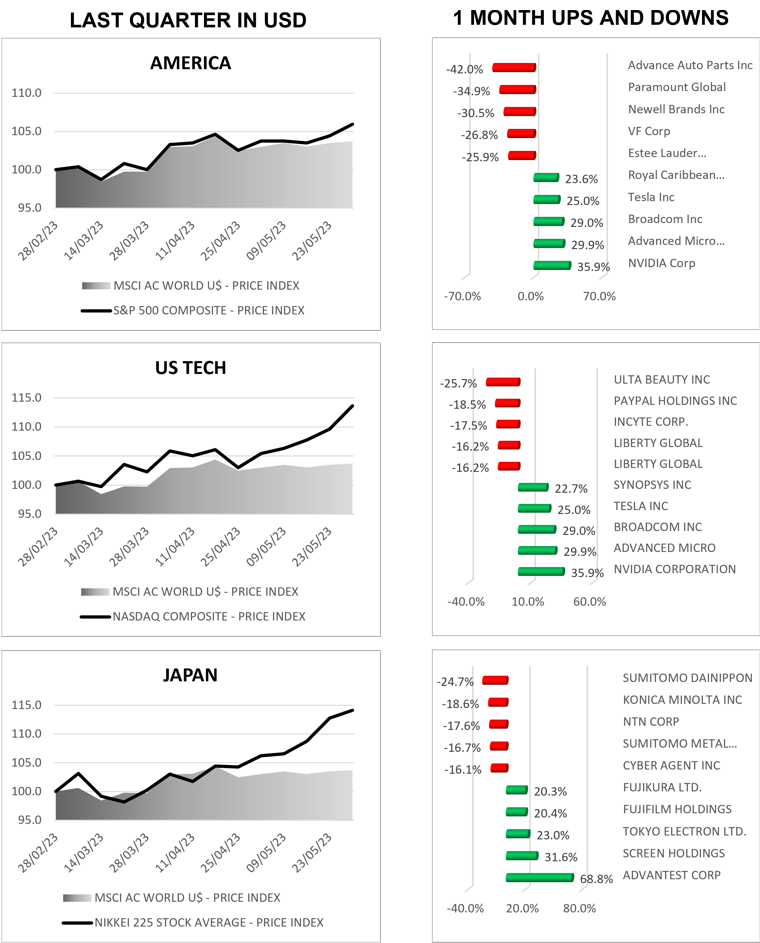

Major indices gained momentum towards the end of the month, as the resolution of the US debt default threat relieved market concerns. Once again, tech stocks outperformed the broader market, with the Nasdaq posting a significant increase of 7.7%. AI-related stocks and other technology companies experienced an impressive rally. Notably, Nvidia surged by 35.9% after raising guidance well above expectations, positioning the company to benefit from the AI boom. Other US stocks, such as AMD (+29.9%), Broadcom (+29.0%), and Tesla (+25.0%), also recorded substantial gains. In Europe, BE Semiconductor (+27.3%), ASMI (+23.3%), and in Japan, Advantest (+68.8%), were among the top performers. However, certain companies faced challenges, such as Samhällsbyggnadsbolaget (-70.3%), which saw its debt downgraded to “junk” status, leading to a restructuring process. Additionally, concerns about fading demand in China’s property sector resulted in declines for Country Garden Holdings (-30.1%), China Overseas Land & Investment (-20.3%), and China Resources Land (-19.1%).

Shifting to economic data, in the US (S&P 500 +0.3%), the Federal Reserve raised interest rates by 25 basis points in May. Despite strong labour market data, it is expected that the Fed will pause in June. Meanwhile, in the UK (FTSE 100 -4.9%) and Europe (EU 600 -3.3%), both central banks are anticipated to raise rates by 25 basis points at their upcoming meetings in June.

Emerging markets faced downward pressure due to Chinese stocks, with the Shanghai Composite declining by 2.4% and the Hang Seng plummeting by 8.5%. Weaker-than-expected economic data in China has raised concerns about a potential rebound, as weak demand and slowing investment weigh on market sentiment.

From Hype to Reality

Artificial Intelligence (AI) has recently fueled strong momentum in the Tech stock rally, sending a clear signal that AI is becoming a reality. This euphoria is rooted in a significant tectonic shift from Mobile computing to AI computing, which will transform the productivity and GDP potential of the global economy.

Every 15 years, the computing industry experiences an evolutionary shift that dramatically changes the computing model and competitive landscape. Each shift is, on average, 10 times larger than the previous era. Research from renowned Jefferies Semiconductor analyst, Mark Lipacis, suggests that we have entered the next tectonic shift, referred to as the Parallel Processing / Internet of Things (IoT) Era. This is the 4th Tectonic Shift and is characterized by Big Data, AI, and Neural Networking.

Microsoft, one of the leaders in AI, has termed AI perfectly: “It’s the capability of a computer system to mimic human-like cognitive functions such as learning and problem-solving.” Consequently, AI is set to be the key source of transformation, disruption, and competitive advantage in today’s fast-changing world.

As AI has the potential to overhaul how companies do business, it will also have a major impact on future earnings. So, how much is this AI opportunity worth, and who stands to benefit?

Various research shows that AI could be worth trillions of dollars. PwC reported that AI could potentially contribute up to $15.7 trillion to the global economy by 2030, representing over 16% of global GDP and equivalent to China’s GDP.

Considering that the Mobile-computing era is worth $4.4 trillion, this estimated AI contribution of $15.7 trillion demonstrates the sheer scale and magnitude of this advancement in computing.

Two of our holdings have cemented their leadership in AI – Microsoft and Alphabet (Google). Both offer massive computing resources and are best positioned to take advantage of the vast, high-quality data and scale provided by their cloud platforms to effectively train and inference AI models. Both continue to integrate AI capabilities into their wide product offerings and hold massive cash reserves, allowing them to invest heavily in AI.

The success of AI applications hinges on the availability of vast amounts of data, consequently leading to a growing demand for data centers to store and process information. As more and more organizations incorporate AI into their operations, there is a corresponding rise in data generation and the need for servers and data centers.

Research suggests that AI-driven hardware spend in 2030 will rise at an annual rate of 67%, up from $16 billion to an astounding $1.7 trillion. This is an enormous tailwind for semiconductor and semi-equipment companies.

The explosion in demand for AI hardware is pointing towards significant revenue growth for software companies down the line. Research shows that during the next 5-10 years, software will generate $8 in revenue for every dollar of demand for AI hardware, as companies are purchasing AI hardware to deliver AI-powered products and services.

Looking at Microsoft specifically, analyst expectations suggest AI could boost revenues by $100 billion by 2027. A back-of-the-envelope calculation indicates an incremental value of $150/shr on top of the current MSFT share price from the AI potential.

Nvidia is currently the marquee name and the primary provider of accelerated computing hardware for developing and running large language models. Hence, Nvidia is an early beneficiary of the boom in generative AI.

Shares of Nvidia soared this month after the company reported Q1 earnings, pushing the shares up a whopping 175% year-to-date. The showstopper in the report was guidance for Q2 revenue of $11 billion, well ahead of the $7 billion expectation and pointing to year-over-year growth of 63%. “We expect this sequential growth to largely be driven by Data Center, reflecting a steep increase in demand related to generative AI and large language models,” said Colette Kress, Nvidia VP & CFO.

Even though Nvidia’s recent share price movement has been stratospheric, and its current valuation stretched, given the AI opportunity, Nvidia has a potential earnings power of $15/shr by 2027 (FY24 est $7.70/shr). If you apply a 40x earnings multiple and discount it back to today, an approximate 15% upside is implied. This suggests that a large portion of the near-term upside is already being priced in.

As stock pickers, we are looking for ways to ride this wave, whether by directly holding AI-related stocks or by buying stocks that will indirectly benefit from this trend. Even though AI remains in the early stages, the hype is real!

By the Numbers

Volatile global markets and country-specific risks had a significant impact on sentiment in May, resulting in a 4.0% decline in the JSE ALSI for the month. Weakness was observed across various sectors, with the financial sector being the hardest hit, experiencing an 8.2% decline. Transaction Capital led the sell-off in this sector, falling an additional 42.6% in May, bringing its year-to-date performance to -79.2%. Banks also faced double-digit declines, with Capitec (-17.7%), ABSA (-12.6%), and Standard Bank (-11%) all being negatively affected. On a positive note, Alexander Forbes recorded a 10.3% increase for the month, followed by Quilter (+8.8%) and Coronation (+8.5%).

The property sector had the second worst performance, declining by 6.2% in May. Equites experienced a significant drop of 23.6% following the release of its 2023 financial year results, where management guided for a decline in distributable income per share for the 2024 financial year. Redefine also saw a decline of 17.9% in May, with concerns about refinancing expiring debt and swaps overshadowing improved fundamentals from their interim results. On the positive side, Stenprop (+8.8%), Sirius (+8.3%), and Nepi (+2.4%) recorded gains for the month.

Industrials fell by 3.1%, primarily driven by a sell-off in Spar (-26.3%), Pick n Pay (-26.1%), and Tiger Brands (-23.8%) due to worse-than-expected operational performances reflected in their results. Anheuser (-14.2%) was impacted by the boycott of Bud Light beer in North America, resulting in weaker beer volumes in April and May.

The resources sector declined by 2.4% despite the continued performance of gold stocks such as Harmony (+11.8%), DRDGold (+10.8%), and Goldfields (+6.1%). The weak performance in the sector was led by Pan African (-19%) and Exxaro (-16.0%). PGM miners also experienced declines for the month, with Sibanye (-11.6%) and Northam (-9.1%) being affected.

Weak sentiment continued to impact retailers, with a marginal decline of 0.14% for the month. Pepkor fell by 16.5% in May, as their results indicated a weak operating environment and a slowdown in consumer spending. Other retailers also saw declines, including Mr Price (-15.7%), Foschini (-14.1%), Truworths (-11.9%), and Woolworths (-8.9%).

Loadshedding May Get Worse but Things are Looking Much Better For 2024

As load shedding costs have become significant in the context of the South African operating environment, we take a closer look at the expectations over the near and medium term.

Eskom’s base case scenario for load shedding over the winter period is stage 5, based on the assumption that unplanned outages will be managed at 15,000 MW. However, based on data we have been tracking over the last 12 months, we believe that unplanned outages will be within the range of 16,000 MW to 18,000 MW, resulting in a base case of stage 8 load shedding.

Unplanned outages have accelerated in 2023 and are currently averaging 16,872 MW. Although breakdowns have improved from the record high of 21,535 MW seen in February, they remain very high, peaking at 19,066 MW in more recent weeks. Should breakdowns continue on this trajectory, we expect they will add at least 3 stages to load shedding, laying the foundation for our stage 8 base case scenario.

It’s not all that bad, as we get through the winter period, the load shedding outlook starts to improve, driving our expectations for lower stages going into 2024.

One of the key factors in the improved outlook is the return to service of Kusile units 1, 2, 3 & 5, and Koeberg unit 1 by December 2023. These units are expected to add 3,180 MW to capacity, improving load shedding by approximately 3 stages. The additional return of Medupi unit 4 in 2024 will further improve capacity by 720 MW. This lays the foundation for lower levels of load shedding going into 2024, despite the expectation of delays, given Eskom’s poor track record.

The silver lining to the slow collapse of Eskom must be the beginning of the privatization of electricity generation, which will ultimately unlock many investment opportunities down the line. Private sector energy generation is expected to play a key role in reducing electricity demand and improving load shedding over the medium term. We have already seen a surge in the imports of solar panels and batteries. This follows the easing of regulations and the introduction of government tax incentives, in an effort to drive both large-scale and rooftop solar power generation.

Private renewable projects are expected to alleviate electricity constraints meaningfully by 2025, as the projects start to come onto the grid. As of February 2023, Eskom data shows that large scale projects that are beyond ‘budget quote phase’ total 14518 MW. Assuming not all projects will be successful, it is conservatively estimated that only 10000 MW will eventually go on stream, with 5000 MW expected to be added to the grid by 2025.

Additionally, rooftop solar is expected to add 1,400 MW from residential projects and 2,100 MW from commercial projects.

In total, private renewable projects and rooftop solar are expected to add 8,500 MW to the supply capacity by 2025. Beyond 2025, the remaining 5,000 MW is expected to come online, with a further 14,200 MW of renewable energy expected from REIPPP projects (bid windows 7 & 8), which bodes well for a long-term resolution to load shedding.

Despite the gloomy prospects over the winter period, the load shedding outlook improves significantly towards the end of the year and going into 2024. The return to service of Kusile, Koeberg, and Medupi units, as well as private sector generation, are key to the improved outlook.

Portfolio Changes

Given the depressed macroeconomic conditions and beaten-down investor sentiment, we re-evaluated our positioning in consumer cyclical stocks. We made the decision to sell our position in Foschini Group (TFG). Initially, we had positioned ourselves in TFG based on a post-COVID recovery growth story, where we expected retailers to benefit from increased demand following muted consumer spending during the pandemic. TFG was considered well-positioned among its peers to benefit from the increased consumer spending, driving top-line growth and overall earnings growth. While this was the case for the 2022 financial year, the resilient operating performance we highlighted in our previous notes, was not reflected in the share price due to weak sentiment in retail stocks.

In the recent trading update for the 2023 financial year, the impact of consumer pressure was evident as sales growth slowed in the fourth quarter. Load shedding costs have been significant, with management reporting a loss of R1.5 billion in sales and a gross margin impact of 2.1% due to inventory build-up and markdowns. We also anticipate that additional unbudgeted diesel costs incurred will further impact operating margins. These factors pose downside risks to earnings expectations in the near term. Despite the low valuations, we do not expect to see a re-rating until the pressures in the South African macroeconomic environment subside.

We are reallocating the proceeds to the Satrix SA Bond ETF, taking into consideration the current level of interest rates. The SA Bond ETF currently offers an attractive yield of 13.06%. With the view that we are nearing peak interest rates and anticipate a potential cut in early 2024, we believe there is potential for capital gains as bond prices adjust to a lower interest rate environment.

We still believe there are opportunities in South African equities, given the overall low valuations. We are patiently awaiting signs of economic improvement before making further investment decisions.

Closing Comments

The local market is currently offering opportunities that come along once a cycle, things may feel bad now but come spring we will be in a better place. Sentiment changes and markets can move quickly. Now is a great time to think about putting money to work.

Likewise, the interest rate hiking cycle coming to an end in developed economies will provide the catalyst for global stocks to move higher again.

The dots are beginning to line up.